For many New Jersey residents, the dream of owning a home has always been a cornerstone of the American Dream—but that dream is becoming harder to reach with each passing year. By 2030, New Jersey is projected to have one of the largest homeownership affordability gaps in the entire country, creating serious challenges for future buyers and raising important questions about housing, income, and the state’s long-term livability.

If you’re planning to buy a home in the next few years or thinking about your place in the state’s real estate market, now is the time to take a deeper look at where things stand—and where they’re headed.

A Snapshot of 2030: High Prices, Higher Hurdles

Fast forward just five years from now, and the Garden State could be among the top five least affordable states for homeownership. Median home prices in New Jersey are projected to hit nearly $845,000, a figure that would rank among the top 10 highest in the country. But it’s not just the sticker price causing concern.

To comfortably afford a home at that price—with mortgage, property taxes, and other housing expenses included—households would need to earn upwards of $210,000 annually. That represents a staggering 94% increase from current median incomes.

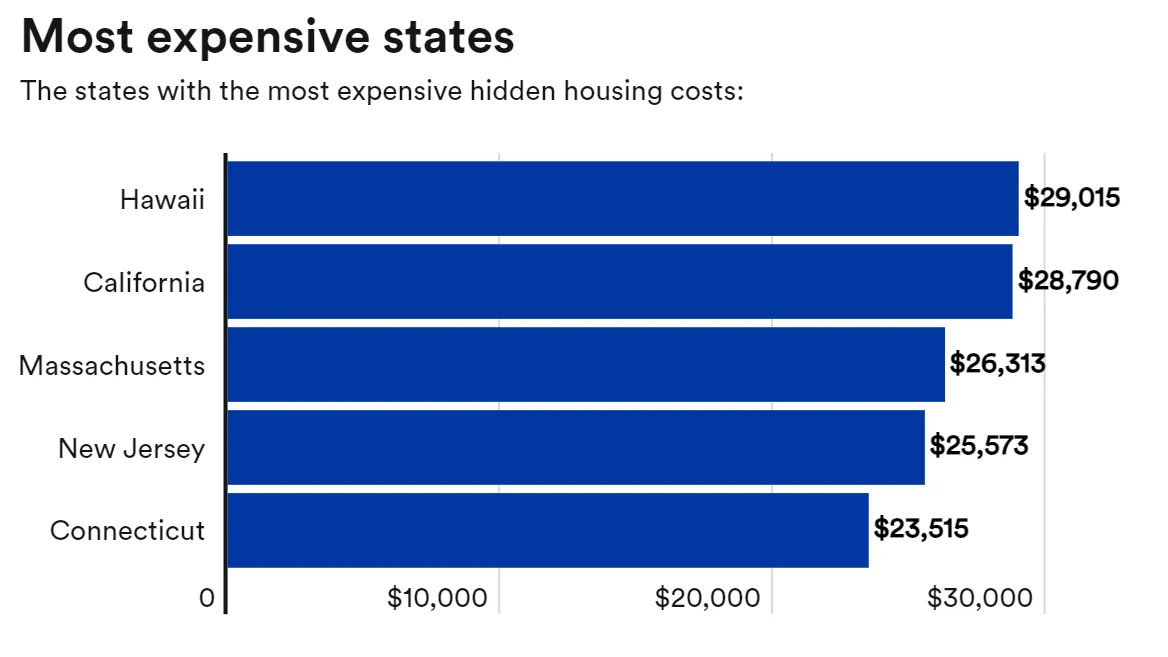

This growing disconnect between income and housing costs means that New Jersey residents will face the fifth-largest affordability gap in the nation by 2030—outpaced only by states like California, New York, and a handful of other high-cost regions.

Why New Jersey Is Feeling the Squeeze

Several factors are converging to widen the affordability gap:

- High Property Taxes: New Jersey consistently ranks among the top states for property taxes, further inflating annual housing costs.

- Demand vs. Supply: With limited land for new development and high demand for housing near major metros like NYC and Philly, prices remain elevated.

- Stagnant Wages: While home prices have soared, income growth has lagged behind—especially in suburban and rural parts of the state.

For young professionals, first-time buyers, and even middle-class families, this affordability imbalance is creating major barriers to entry into the housing market.

What This Means for Buyers and Renters

As homeownership becomes less attainable for many, we’re likely to see several ripple effects across the state:

- More people renting longer, especially younger adults and those without generational wealth.

- Increased competition for smaller, more affordable homes, driving up prices even further in that segment.

- Migration to less expensive areas, both within the state and to neighboring regions, as residents seek more affordable lifestyles.

For anyone considering a move—or trying to plan for the future—it’s more important than ever to stay informed on local market trends. If you’re navigating New Jersey’s changing housing landscape, our real estate section offers the latest updates, insights, and expert perspectives.

Opportunities in a Challenging Market

While these numbers might sound discouraging, it’s not all doom and gloom. There are still opportunities for savvy buyers, strategic investors, and proactive communities. Some possible bright spots include:

- Revitalized urban centers like Newark, Trenton, and Camden, where new development and investment are creating more affordable living options.

- First-time homebuyer programs offering assistance with down payments, closing costs, and mortgage rates.

- Mixed-use and multi-family housing developments that can help ease the burden for both renters and owners alike.

Staying ahead of the curve and understanding where affordability still exists—whether it’s in South Jersey suburbs or revitalizing downtowns—can make all the difference.

A Call to Action: Planning for the Future

New Jersey’s affordability crisis isn’t just a real estate issue—it’s a community issue, a workforce issue, and an economic issue. If the projected trends hold, many residents could find themselves priced out of the neighborhoods they grew up in or pushed into long-term renting with limited upward mobility.

That’s why it’s crucial to start thinking ahead. Whether you’re looking to buy your first home, downsize, invest, or simply stay informed, understanding where the market is headed is the first step.

Visit our real estate hub to explore guides, property trends, neighborhood spotlights, and advice for navigating today’s—and tomorrow’s—market. Let’s shape a future where homeownership remains an achievable goal in the Garden State.

Explore New Jersey isn’t just about discovering places—it’s about understanding the forces shaping our lives. From rising home costs to community development and beyond, we’re here to help you navigate New Jersey with clarity, insight, and confidence.

Let us guide you toward smarter decisions and deeper connections in the place we all call home.