There’s no shortage of political drama in Washington these days, but one debate has New Jersey homeowners watching more closely than usual. A fresh tax proposal is stirring up tension in Congress—especially over a hot-button issue that hits close to home for many Garden State residents: the State and Local Tax (SALT) deduction cap.

At the heart of the matter is a proposal to raise the SALT deduction cap from its current $10,000 limit to $30,000. And if you’re a homeowner in a high-tax state like New Jersey, that could have a serious impact on your federal tax bill—and your wallet.

Let’s unpack what’s going on, why it matters for New Jersey, and what it means for families, homeowners, and taxpayers across the state.

🔍 What Is the SALT Deduction, and Why Does It Matter?

The SALT deduction allows taxpayers to deduct certain state and local taxes—such as property taxes and state income taxes—on their federal income tax return. For years, this was an essential break for people living in high-tax states, helping offset the cost of living in places like New Jersey, New York, and California.

That changed with the 2017 Tax Cuts and Jobs Act, which capped the SALT deduction at $10,000 per household. The cap disproportionately impacted states with high property values, steep income tax rates, and generally higher costs of living. For many New Jersey families, this meant losing thousands in potential deductions.

Now, a group of lawmakers—many from these high-tax states—are pushing back, demanding an increase in the cap as part of the new House Republican tax package. Some are even threatening to vote down the entire bill unless the SALT cap is addressed.

💸 Why New Jersey Stands to Gain the Most

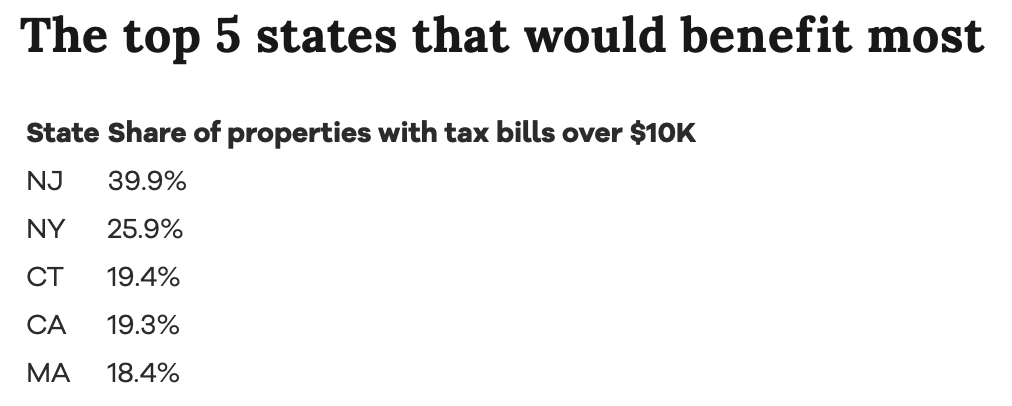

Few states feel the SALT deduction pain like New Jersey. With some of the highest property taxes in the nation and a significant number of residents paying more than $10,000 annually in combined property and state income taxes, the current cap hits hard.

Here’s why an increased SALT deduction could be a game-changer for New Jersey:

- High property taxes: The average property tax bill in New Jersey is well over $9,000—and in many counties, it’s much higher.

- High income taxes: New Jersey residents face state income tax rates that range up to nearly 11% for top earners.

- Dense population of homeowners: The impact of the cap is felt statewide, not just in high-income brackets. Many middle-class families are affected too.

Under the new proposal, the SALT deduction cap would be raised to $30,000, providing meaningful relief to homeowners who’ve been capped out for the past few years. But not everyone is convinced this is enough.

⚖️ The Political Tug-of-War

The SALT debate is creating unusual alliances and growing tensions within the Republican party. On one side, fiscally conservative members argue that increasing the SALT cap benefits wealthier Americans and undermines broader goals of federal tax reform. On the other, moderate Republicans from high-tax blue states are adamant that their constituents are being unfairly penalized.

The bill, which includes other tax measures, has already hit roadblocks in the House—partly due to these internal disputes. Several New Jersey lawmakers are among those holding the line and demanding changes before they’re willing to give their vote.

There’s a growing sentiment among these lawmakers that New Jersey taxpayers deserve better, especially after years of being shortchanged by a cap that doesn’t reflect the state’s economic reality.

📍 For updates on where New Jersey lawmakers stand, visit Explore New Jersey Politics

🏡 What It Means for Homeowners

If the proposal to raise the SALT cap passes, the most immediate winners will be New Jersey homeowners—particularly in counties like Bergen, Essex, and Somerset where tax bills routinely exceed $10,000.

Let’s break down how this could help:

- More deductions = smaller federal tax bill: Increasing the cap means more of your state and local taxes become deductible. That could lead to thousands in additional savings.

- Easing the cost-of-living burden: With mortgage rates and inflation high, even modest tax relief is meaningful.

- Improved home value stability: Greater tax deductions can positively affect real estate markets, especially in high-tax areas where affordability is a concern.

But there’s still uncertainty. Until Congress reaches a deal, taxpayers are left wondering how to plan ahead.

🔮 What Comes Next?

The future of the SALT cap increase is far from certain. Negotiations are ongoing, and it’s possible that the final version of the bill will either modify or eliminate the provision entirely. Some lawmakers are even calling for a full repeal of the SALT cap, not just a temporary raise.

Others are suggesting income-based thresholds, where only taxpayers below certain income levels would benefit from a raised cap—an effort to blunt criticisms that the change primarily benefits the wealthy.

Regardless of where the debate lands, one thing is clear: New Jersey residents are watching closely, and they have more at stake than most.

🗣️ Final Thoughts: Time for Fairness?

The SALT deduction cap has long been a thorn in the side of New Jersey homeowners. And as the political drama unfolds in Washington, this may finally be the moment that brings meaningful change.

If the proposal passes, it will be a small but important win for the Garden State—an acknowledgment that federal tax policy should reflect the real-world cost of living in high-tax regions. And for those who’ve felt the sting of the cap for the past several years, that relief is long overdue.

For more updates on New Jersey’s political landscape and how changes in Washington affect us here at home, stay connected with Explore New Jersey Politics.

Tagged: #SALTCap #NewJerseyPolitics #TaxReform #ExploreNewJersey #PropertyTaxes #NJTaxRelief #GardenStateSALT #CongressTaxDebate #FederalTaxPolicy #WashingtonUpdates