[ad_1]

Economy

By Anthony Birritteri, Editor-in-Chief On Dec 4, 2024

The 2025 economic outlook is a mixed bag for New Jersey businesses that, under a new Trump administration, may experience growth under the deregulation of certain industries, while being negatively impacted by tariffs on foreign imports and a crackdown on immigration.

Additionally, New Jersey’s own financial outlook, with a structural deficit of more than $4.5 billion, coupled with high property taxes, a high-income tax rate, and the highest corporate business tax in the nation, will also be challenging for businesses unless the state delivers stability in its public policy initiatives.

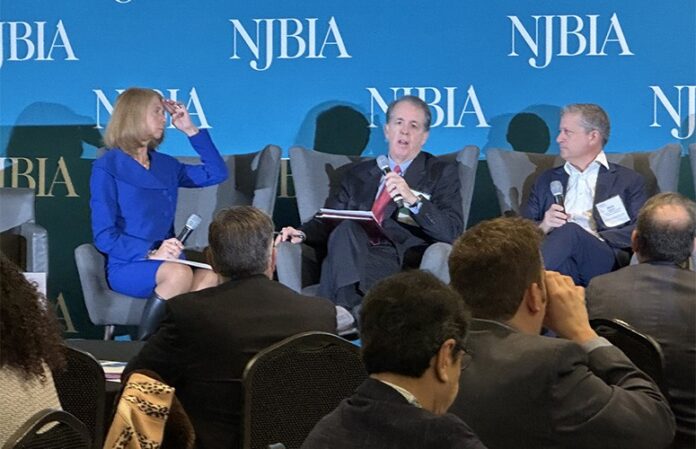

These issues and other issues were presented before a business audience of more than 220 during a fireside chat on the economy at the New Jersey Business & Industry Association’s annual Public Policy Forum held at the APA Hotel Woodbridge today.

NJBIA President and CEO Michele Siekerka moderated the discussion, which included Andrew Sidamon-Eristoff, a former state treasurer and now owner of ASE Tax Policy and Administration, LLC, and Mark Lehman, CEO of Citizens JMP Securities and president of Citizens in California.

When asked by Siekerka what his overall view was concerning the nation’s economy next year, Lehman said 2025 will “start out roaring.” This is because of “great” economic growth these past four years as the nation emerged from the COVID-19 pandemic and businesses benefited from the Tax Cut & Jobs Act and the Build Back Better program, which included the American Rescue Plan.

Lehman said the stock market has done well the past four years and that there has been a lot of euphoria on Wall Street these past four weeks. He’s optimistic about 2025, but cautioned, “there is always something lurking around [the corner]. I’m afraid we are getting a little too euphoric.”

The Trump Effect

Under the incoming Trump administration, Lehman said there will be profound changes, especially concerning tariffs on foreign countries.

Sidamon-Eristoff said that these tariffs will especially impact the 20,000 New Jersey companies that are involved in exporting and the 1.2 million jobs here that are connected to international trade. “That’s 1 in 5 jobs, so any talk on tariffs is very serious,” he said.

He added that he is not sure if the Trump administration will follow through on all the president elect’s tariff proposals and crackdowns, pointing to Trump’s last administration when tens of thousands of individual tariff exemptions were given to companies.

Meanwhile, Lehman said he doesn’t think that the administration will deport millions upon millions of illegal immigrants that the incoming president is calling for.

“There definitely will be some communities that will be affected disproportionately, with some retribution-type scenarios from the administration. However, I think entire complex of foreign workers going away is not going to happen … the numbers are too daunting,” Lehman said, while stressing once more that there will be some “profound repercussions … because the electorate wants it. Trump has done a very good job in making that loud and clear to people.”

NJ’s Fiscal Problems

Looking at New Jersey’s fiscal problems, Sidamon-Eristoff said much of the new spending in the state’s FY2025 budget, at $56.7 billion, is unsustainable. The state has drawn down some $2.4 billion from its budget surplus, while the structural deficit is north of $4.5 billion, according to Sidamon-Eristoff. The Stay NJ property tax relief program for seniors alone will require an increased appropriation of $1.3 billion over the next few fiscal years, he said.

He called Gov. Phil Murphy’s call for each state department to freeze hiring and find 5% in budget savings as just “window dressing” and that the next governor will have to deal with all the fiscal issues.

When asked by Siekerka what the state can do to be more tax friendly, Sidamon-Eristoff said an important solution is creating stability in public policy, whether its taxes, spending or regulatory. Additionally, he said that the increase of the corporate business tax was a prime example of how not to handle state tax policy. “It singled out New Jersey as an unreliable public policy partner with the business community. It signaled to the rest of the country, if not the world, that New Jersey is less competitive,” he said.

Further delving into the high tax dilemma on both the state and local level, Sidamon-Eristoff said that it is a cultural issue in New Jersey that must be addressed inside and outside of government.

To access more business news, visit NJB News Now.

Related Articles:

[ad_2]

Source link