Explore Jersey City’s real estate scene continues to be a topic of conversation, especially with the recent sale of Penthouse 3414 at The Emerald, which broke records with a $1.8 million sale price. This landmark event at The Emerald, a luxury residential building on Jersey City’s waterfront, not only highlights the demand for upscale properties in the area but also offers a snapshot of the current state of the New Jersey housing market amid broader national trends.

While high-end properties like Penthouse 3414 continue to set records, a significant portion of Americans, particularly renters, feel that homeownership is slipping further out of reach. Recent data indicates a shift in public perception of the housing market, with many potential buyers feeling priced out or uncertain about the future. Let’s take a closer look at the latest housing trends, including the impact of rising home prices, shifting buyer intentions, and how Jersey City is positioning itself in the ever-changing market.

🏙️ $1.8 Million Penthouse Sets New Sales Record at The Emerald

Penthouse 3414 at The Emerald in Jersey City has officially set a new sales record for the building, fetching an impressive $1.8 million according to the MLS. This marks the highest sale ever in the luxury residential tower, which boasts panoramic views of the New York City skyline and proximity to the waterfront.

The sale highlights the continued demand for luxury properties in Jersey City, especially with its stunning views and strategic location near Manhattan. As the real estate market in the area becomes more competitive, properties like this penthouse continue to attract affluent buyers looking for high-end living in one of the most desirable locations in the region.

But while these high-priced properties continue to perform well, the broader housing market tells a different story.

🏡 Rising Home Prices and the Growing Divide

Nationwide, the housing market is showing signs of disconnection between the wealthy and those hoping to enter the homeownership ladder. Data suggests that homeownership rates have been steadily declining since the housing crash of the late 2000s. According to recent findings, about 62% of Americans currently own homes, while 34% rent—a ratio that’s relatively unchanged from previous years.

However, homeownership rates remain well below pre-2008 housing crash levels, when they consistently hovered around 70% or higher. The current situation presents challenges for many Americans, especially for non-homeowners. Two-thirds of renters and non-homeowners have reported feeling priced out of the market, largely due to rising home prices and interest rate hikes that have made financing more difficult.

While high-end luxury sales like the one at The Emerald may indicate a booming market for affluent buyers, it also underscores the growing affordability gap. For many potential homebuyers, the dream of purchasing a property is becoming more distant.

From Gallup:

Housing Market Perceptions Dampen Homebuying Intentions

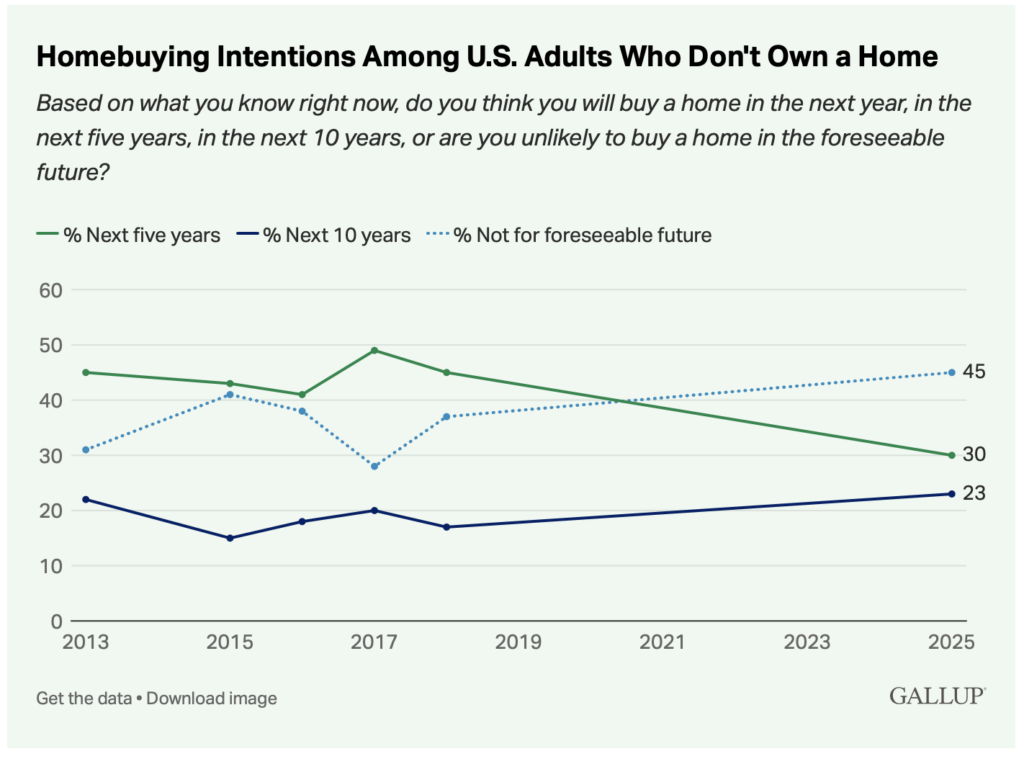

Homeownership appears to be further out of reach for non-homeowners in the U.S. Two-thirds of these Americans report being priced out of the market, and the smallest percentage recorded in years say they expect to buy a home within the next five or 10 years. More generally, Americans remain broadly skeptical about the housing market, as they have been since 2022, with the majority saying it’s a bad time to buy a house.

The survey finds that 62% of Americans say they own a home, while 34% indicate they rent, which is similar to the figures from recent years. Homeownership rates were higher before the housing crash in the late 2000s, consistently registering 70% or higher between 2005 and 2009.

It doesn’t appear that homeownership rates are likely to increase substantially in the near future. Among those who do not own a home, 30% think they will buy one within the next five years, 23% in the next 10 years and 45% not for the foreseeable future.

The percentage of those who expect to buy in the near term is significantly lower than what Gallup measured in prior surveys, all conducted between 2013 and 2018, when no fewer than 41% of non-homeowners expected to buy a home in the next five years. Similarly, the combined percentage planning to buy within five or 10 years, 53%, is the lowest that Gallup has recorded.

📉 Shifting Homebuying Intentions: The Confidence Gap

A recent survey found that only 30% of non-homeowners believe they will be able to purchase a home within the next five years, and only 23% expect to buy within the next 10 years. This marks a significant drop from previous surveys conducted between 2013 and 2018, when more than 40% of renters anticipated buying a home within the next five years.

The shift in homebuying intentions can be attributed to several factors:

- Rising Mortgage Rates: With higher interest rates, potential buyers are faced with higher monthly payments, which makes homes less affordable, especially in competitive markets like New Jersey and New York.

- Stagnant Wage Growth: Although wages have increased slightly in recent years, they have not kept pace with the rising home prices, making it increasingly difficult for many to save for a down payment or qualify for a mortgage.

- Market Skepticism: Many Americans remain broadly skeptical about the housing market, with a growing consensus that it’s a bad time to buy a house. According to the survey, the majority of renters believe that market conditions, particularly home prices, are not conducive to purchasing a home in the near future.

🏘️ The Shift in Market Perception: Renters Feeling Left Behind

As a result of these factors, the American dream of homeownership seems further out of reach for a significant portion of the population. Among those who rent, nearly half are not considering purchasing a home at all, with many feeling priced out by rising costs. This mindset marks a stark contrast to previous years when a higher percentage of renters believed they would eventually own their own home.

Interestingly, as the New Jersey real estate market becomes increasingly competitive, Jersey City’s real estate is seeing mixed signals. While luxury units and penthouses continue to break sales records, a growing number of potential buyers are expressing reservations about entering the market.

🚪 What Does This Mean for Future Buyers in Jersey City and New Jersey?

The landscape of homeownership in New Jersey—especially in cities like Jersey City—is changing. While high-end real estate continues to thrive, the broader housing market faces challenges in accommodating middle-class buyers. The surge in luxury properties such as The Emerald’s penthouse can coexist with growing concerns about affordability and the future of homeownership.

As Jersey City and surrounding areas continue to develop, there are still opportunities for buyers to find homes in desirable neighborhoods at a variety of price points. However, with increasing demand, limited inventory, and higher interest rates, the market will remain competitive and challenging for first-time buyers and middle-income families.

🏠 The Bottom Line: Housing Market Still a Mixed Bag

In conclusion, while the sale of Penthouse 3414 at The Emerald highlights the ongoing strength of the luxury real estate market, it also underscores the broader challenges within the housing market that affect first-time homebuyers and those looking for more affordable options. With homeownership rates at their lowest point in years and an increasing number of renters unable to consider buying, the American dream of owning a home may be slipping further out of reach for many.

For now, Jersey City continues to be a hub for luxury living, but affordability remains a concern as the housing market tries to balance the desires of high-end buyers with the needs of everyday Americans seeking to find a place to call home.