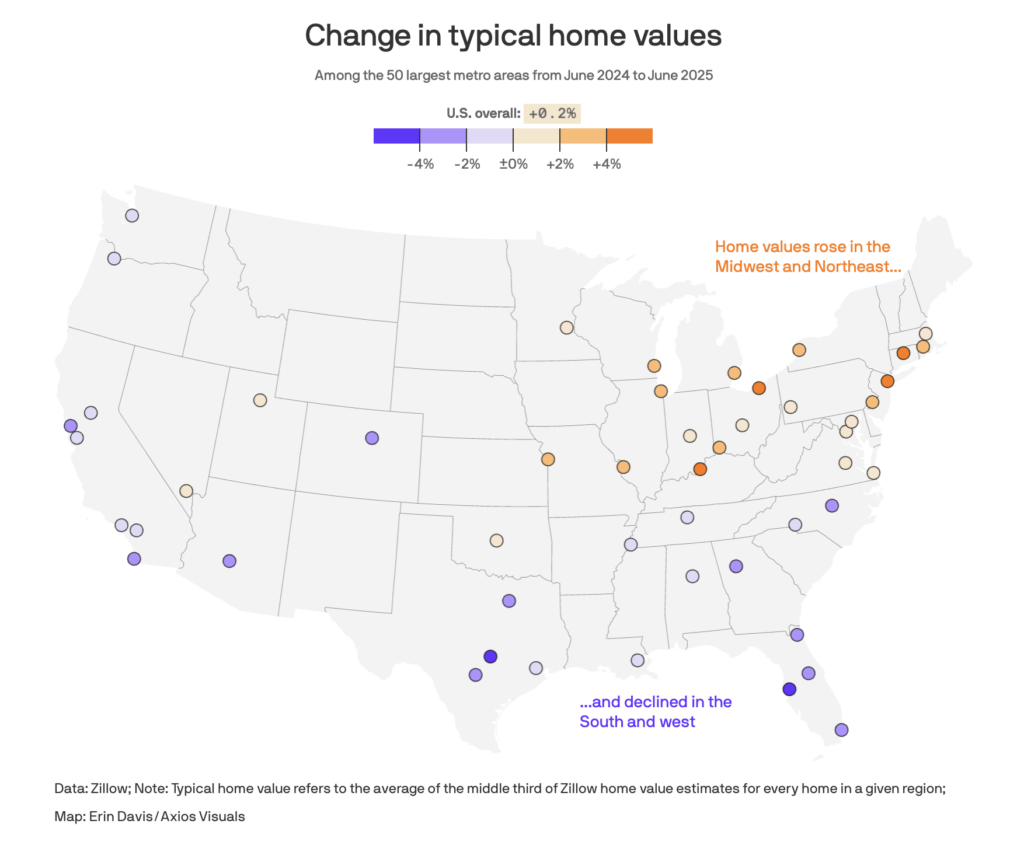

The American housing market is currently telling two very different stories. In half the country, home prices are continuing to rise, while the other half is starting to see values slide. It’s a tale of two housing markets, and New Jersey sits firmly on the side where prices remain stubbornly high—and are even climbing in many areas.

So, why is the Garden State defying the national cooling trend in real estate prices? The answer isn’t just about interest rates or affordability. It’s about demand, supply shortages, zoning restrictions, and the unique appeal of New Jersey’s suburban-urban balance.

For more insights into New Jersey’s real estate landscape, visit our Real Estate coverage.

While the South Cools Off, New Jersey Heats Up

In regions like Texas and Florida, the housing boom that exploded post-pandemic is now hitting a saturation point. Years of rapid new construction, rising insurance costs, and escalating climate risks—particularly hurricanes and flooding—are pushing prices downward. Homeowners in these southern states are increasingly putting their homes up for sale, not only because of higher costs of living but also out of concern for long-term climate impacts.

In stark contrast, New Jersey’s housing market remains hot, and it’s all about limited inventory and persistent demand.

Supply Shortages Are Driving New Jersey’s Price Resilience

Unlike Texas or Florida, New Jersey isn’t exactly brimming with wide-open spaces for sprawling new developments. Our state’s zoning laws, suburban density, and limited land for expansion have kept the supply of new homes constrained for years. Even as the demand continues to rise—especially in commuter-friendly areas close to New York City and Philadelphia—the number of available homes simply isn’t keeping up.

For buyers, this tight supply means home prices remain competitive. For sellers, it creates an environment where listing a home often leads to multiple offers, even in a market with elevated mortgage rates.

The Suburban Comeback: Why New Jersey is in High Demand

In a post-pandemic world where remote work has changed how people think about where they live, New Jersey’s suburban communities have become prime real estate targets. Towns with easy rail access to Manhattan, charming downtowns, excellent school systems, and proximity to the Jersey Shore are seeing bidding wars and rising property values.

Unlike southern states where many homes are vacation properties or investment rentals, New Jersey’s housing stock is dominated by primary residences, which reduces speculative selling. Homeowners are holding on, further tightening inventory.

Additionally, New Jersey is perceived as less vulnerable to severe climate disasters, compared to hurricane-prone regions. While coastal areas in the state still deal with flooding concerns, inland and elevated neighborhoods are attracting buyers looking for safer long-term investments.

Housing Affordability Challenges Still Loom Large in New Jersey

Of course, New Jersey’s market isn’t immune to affordability concerns. High home prices coupled with 6%–7% mortgage rates continue to sideline first-time buyers. The median home price in many North Jersey counties is well above the national average, making it tough for young families to enter the market.

But this limited affordability is also what’s keeping the existing housing stock valuable. Homeowners with locked-in low interest rates have little incentive to sell, keeping inventory at historic lows. That pressure cooker of demand versus supply continues to push prices up, even as mortgage rates weigh down overall demand.

Explore more about the affordability and inventory crunch in New Jersey’s real estate market in our Real Estate section.

Insurance Costs & Climate Risks: Why New Jersey Feels Safer Than the Sunbelt

In regions like Florida, skyrocketing homeowners insurance premiums are forcing people to reconsider their living situations. Flood risks, hurricane threats, and the financial toll of insuring properties in vulnerable areas are leading to a sell-off of both primary and secondary homes.

New Jersey, while certainly not immune to flooding in some areas, presents a more stable climate outlook. Buyers looking to relocate from high-risk zones are eyeing suburban and inland New Jersey towns as safer, more predictable investments. This influx of out-of-state buyers is further bolstering demand in select New Jersey housing markets.

The Bottom Line: New Jersey’s Housing Market is Built Different

While much of the country is seeing a housing correction, New Jersey’s real estate market remains on solid ground, thanks to:

- Limited new housing supply

- High demand in commuter towns and suburbs

- Lower climate-related insurance risks compared to southern states

- A high percentage of owner-occupied primary residences

- Zoning laws that prevent overbuilding and maintain community character

However, affordability challenges persist, and unless supply increases or mortgage rates drop significantly, New Jersey will continue to face a competitive, inventory-tight market that favors sellers.

For the latest real estate trends, property spotlights, and housing market insights, stay connected with our dedicated Real Estate coverage.

What’s Next for New Jersey’s Housing Market?

Looking ahead, New Jersey’s housing story is one of long-term resilience with pockets of intense competition. As economic conditions evolve, expect suburban markets with good transit links and strong school systems to continue outperforming the national average.

The big question is whether state and local governments will address housing shortages through smart zoning reforms and incentives for responsible development. Until then, the Garden State’s housing prices are likely to remain robust, standing in contrast to the cooling trends of oversupplied markets in other parts of the U.S.