As of mid-September 2025, the New Jersey Department of the Treasury has begun distributing the latest round of ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) property tax relief payments. This initiative is designed to provide much-needed financial relief to homeowners and renters across the state, especially those most in need. Whether you’re a homeowner, renter, senior citizen, or individual with disabilities, the ANCHOR program aims to ease the burden of property taxes and ensure that residents can continue to thrive in the Garden State.

Payment Distribution and Timeline

The initial payments have already been sent out to residents 65 and older and those with disabilities who qualify for the program. For these residents, the distribution is prioritized, recognizing their unique needs in the community.

For the rest of New Jersey’s eligible homeowners and renters, payments will be sent on a rolling basis over the next 90 days. This phased approach ensures that everyone who qualifies will receive their payment in due time.

Payments are made via direct deposit or paper check, depending on the individual’s preference as indicated during their application process. If you’ve already submitted your details and selected a preferred method of payment, you will receive your relief accordingly.

For residents who were enrolled in the ANCHOR program last year, around 1 million New Jerseyans will benefit from automatic filing this year. These individuals should have received confirmation letters in August 2025 informing them that their application for this year’s benefit has already been processed.

However, the October 31, 2025 deadline is fast approaching for those who have yet to apply or who need to manually file their application for 2025. It’s important to stay on top of this date to ensure that you don’t miss out on any potential relief.

Eligibility and Benefit Details

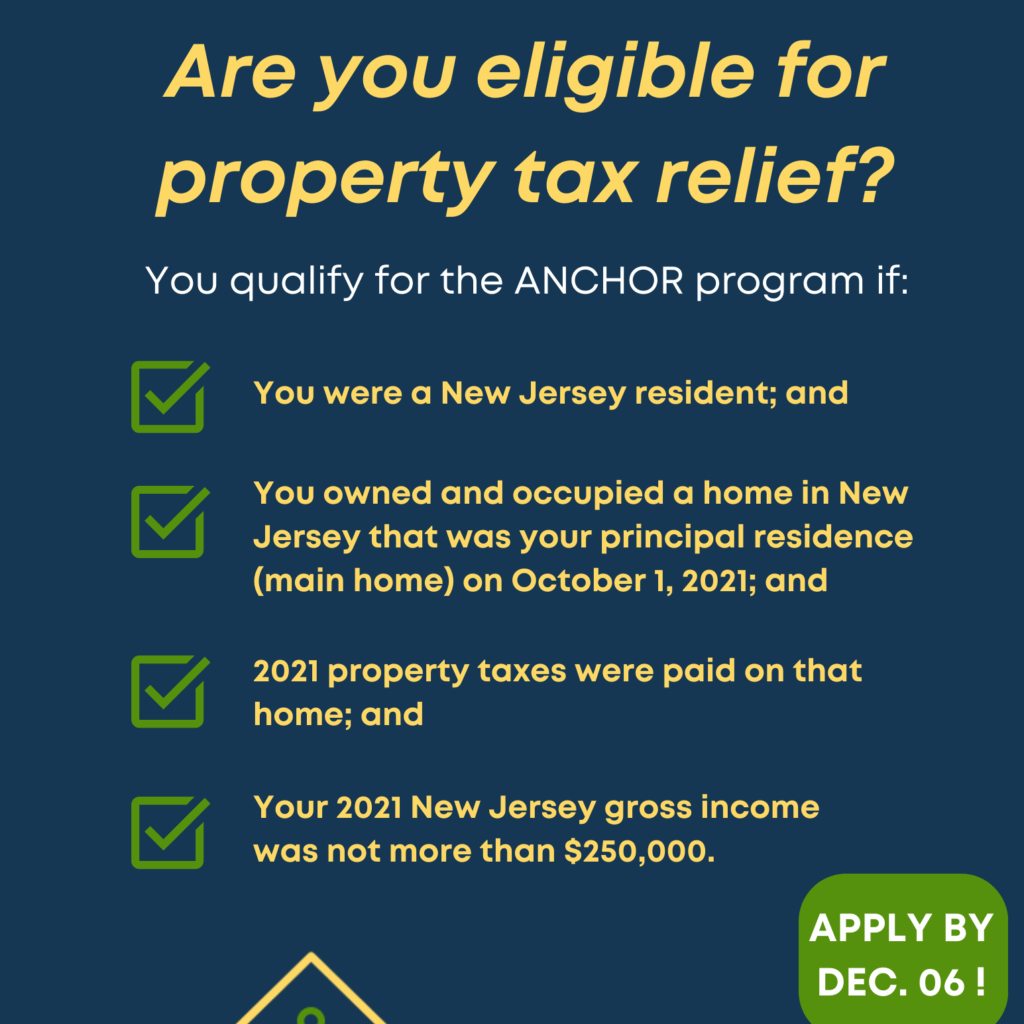

The ANCHOR program provides property tax benefits based on two key factors: income and age. The benefit amounts have remained consistent over the past four years, offering stability for New Jersey residents.

For homeowners:

- If your income is up to $150,000, you are eligible for a $1,500 benefit. Additionally, homeowners who are 65 or older are entitled to an extra $250.

- If your income falls between $150,001 and $250,000, you are eligible for a $1,000 benefit. Seniors in this income range will also receive the additional $250.

For renters:

- Renters with an income of up to $150,000 are eligible for a $450 benefit, with an additional $250 for those who are 65 or older.

This consistent support has made a significant impact, especially in helping seniors and low-to-moderate income households manage the rising costs of living and property taxes.

Important Changes for Applicants in 2025

There are some important changes to the application process this year, particularly for seniors and disabled individuals. In the past, many applicants were automatically enrolled for the ANCHOR program; however, manual filing is required for certain individuals in 2025.

Here are some key points to keep in mind:

- Seniors and Disabled Applicants: Those aged 65 and older or who receive Social Security disability must submit the new combined Property Tax Relief Application (Form PAS-1) this year, even if they were automatically enrolled last year.

- Address or Bank Account Changes: If your address or bank account information has changed since last year, you’ll need to submit a new application online. This ensures that the state has accurate information for payment distribution.

- Identity Verification: The process has shifted, and the state no longer mails ID/PIN numbers for online applications. Instead, applicants must verify their identity using ID.me, a secure identity verification service.

These changes ensure that the process is more streamlined and efficient while protecting residents’ personal information.

How to Check Your Benefit Status

If you’ve already applied and want to know the status of your ANCHOR payment, there are easy ways to get updates:

- Online: You can visit the New Jersey Department of the Treasury’s ANCHOR page for the latest details about your application status and payment progress. This page also provides important forms and additional resources to guide you through the process.

- Hotline Assistance: If you prefer speaking to a representative, you can contact the New Jersey Treasury Hotline at 609-826-4282 or 1-888-238-1233. They can answer any questions you might have regarding your application, payment status, or eligibility.

- In-person Assistance: If you need more direct support, there are free in-person assistance events being held across the state to help with both ANCHOR and PAS-1 filings. These events can provide one-on-one help for individuals who need more guidance or have specific questions.

More Information on New Jersey Real Estate

For New Jersey homeowners and renters, understanding the real estate market can also play a significant role in how property taxes and the ANCHOR program impact their daily lives. Whether you’re looking to buy, sell, or rent in New Jersey, it’s crucial to stay updated on local market trends, property values, and policies that affect homeowners across the state.

For more insights and resources on real estate, be sure to check out Explore New Jersey’s Real Estate Section. This comprehensive resource provides the latest news, tips, and trends in the New Jersey property market, ensuring you’re equipped to make informed decisions.

Conclusion

With the 2025 ANCHOR property tax relief payments now being distributed, New Jersey residents have a great opportunity to receive much-needed financial relief. The direct deposit or paper check options ensure ease of access for those who qualify, while the rolling payment system allows for timely distribution. If you’re eligible, don’t wait—be sure to file your application before the October 31 deadline. For more updates and detailed information on the ANCHOR program and real estate news, visit Explore New Jersey’s dedicated real estate section. This program offers critical support to homeowners and renters alike, providing a vital lifeline for those in need.