New Jersey’s commercial real estate sector is closing 2025 with remarkable momentum, fueled by industrial expansion, high-value multifamily projects, and significant waterfront redevelopment. Despite a cautious national market, New Jersey continues to stand out as a hub of investment activity, drawing both local and national developers seeking prime industrial corridors, urban mixed-use opportunities, and strategic residential projects. Readers looking for more insights on statewide property trends can explore the real estate section on Explore New Jersey.

The industrial sector remains the most resilient segment of the state’s market, driven largely by last-mile distribution and logistics hubs serving dense metropolitan populations along the I-95 corridor. In Hamilton, Hillwood recently broke ground on a 221,000-square-foot speculative industrial facility at 2772 Kuser Road, with completion expected in the third quarter of 2026. Resource Realty of Northern New Jersey (RRNNJ) has similarly finalized deals totaling 116,000 square feet across Warren and Morris counties, highlighting ongoing demand for modern warehouse and distribution space. Jersey City is also seeing logistical transformations, including the redevelopment of the former Daily News plant into a new logistics center, reflecting the city’s pivot toward industrial and mixed-use adaptability. Cushman & Wakefield’s Northeast Industrial team has been active in the capital markets, completing $257 million in investment sales spanning over one million square feet in the New Jersey–New York corridor to start the fourth quarter of 2025.

Residential and mixed-use development has also experienced a surge of activity. In Newark, a luxury multifamily complex at 22 Fulton Street secured nearly $250 million in financing, demonstrating strong investor confidence in urban residential demand. Jersey City has attracted high-profile capital, with Goldman Sachs funding a $200 million mixed-income tower and Kennedy Wilson alongside Affinius providing a $384 million construction financing package for another multifamily project. Waterfront redevelopment remains a key focus, exemplified by the sale of Harborside 8 & 9 for $75 million to Panepinto Properties. These two high-rise towers will collectively add over 1,250 residential units and 23,000 square feet of retail space along the Hudson River, with comprehensive indoor and outdoor amenities and direct connectivity to the Exchange Place PATH station and Harborside Light Rail stop. The Harborside 8 tower alone will feature 678 units, 8,578 square feet of retail, a 350-space parking garage, and a redesigned 40,000-square-foot public park, while Harborside 9 includes 579 units, 14,800 square feet of retail, and a 555-space structured garage, including 87 affordable housing units. The development will also introduce a new east-to-west dead-end street between the two towers to enhance pedestrian and vehicular circulation.

Panepinto Properties Acquires Jersey City’s Harborside 8 & 9, Paving the Way for a Major Waterfront Transformation

Jersey City’s waterfront is poised for a dramatic transformation as Panepinto Properties officially takes ownership of the high-profile Harborside 8 & 9 development, a two-tower project currently under construction along the Hudson River. The acquisition, valued at $75 million, includes a former surface parking lot spanning roughly four acres at 2 Second Street and 242 Hudson Street. This marks one of the largest redevelopment transactions along Jersey City’s waterfront in recent years and signals continued momentum in the city’s luxury and mixed-use property market. Readers interested in additional New Jersey property developments can explore the real estate section on Explore New Jersey.

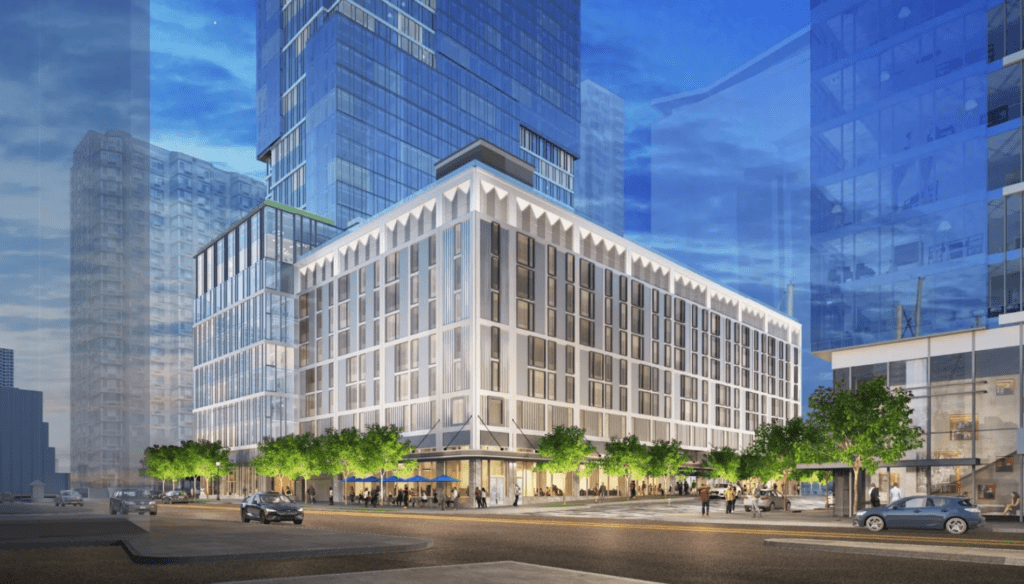

The Harborside 8 & 9 project has a history of ambitious planning. Initially approved in 2020 under developer Mack-Cali, the site was originally slated for three towers. The plan was subsequently scaled to two buildings, with the second tower, Harborside 9, receiving approval last summer. With the purchase by Panepinto Properties, construction is moving forward, beginning with the 68-story Harborside 8 tower, where piledriving work has officially commenced. Designed by Elkus Manfredi Architects, Harborside 8 will feature 678 residential units, 8,578 square feet of retail space, a 350-space parking garage, and a redesigned 40,000-square-foot public park along the Hudson River, creating a dynamic and accessible waterfront environment.

The second phase, Harborside 9, will rise 57 stories and include 579 units, with 14,800 square feet of retail space and a 555-space structured parking garage. Notably, the project incorporates a 15% affordable housing component, resulting in 87 units designed to meet local housing needs. Both towers are planned to offer a mix of indoor and outdoor amenities, including landscaped terraces, recreational areas, and pedestrian pathways, while enhancing connectivity to the existing Harborside campus. A new east-to-west dead-end street between the two towers will improve traffic flow and access, further integrating the development into the surrounding urban fabric.

The sale also represents Veris Residential’s full exit from the Harborside complex. The real estate investment trust has been gradually divesting non-core office properties and shifting its focus to multifamily holdings. Cushman & Wakefield facilitated the transaction, highlighting the significance of the sale for both parties. Veris CEO Mahbod Nia described the deal as “a significant milestone in the continued execution of our strategic plan to monetize non-strategic assets and further strengthen our balance sheet.”

Panepinto Properties has a long history of shaping Jersey City’s skyline. Joseph Panepinto Sr., the company’s founder and CEO, emphasized the project’s transformative potential: “This acquisition reflects my long-standing belief that this formerly industrial waterfront would evolve into a modern, world-class community. Having represented Jersey City in its early redevelopment, helping shape its rising skyline has been a defining part of my life’s work. I look forward to keeping that progress a priority.”

Once complete, Harborside 8 & 9 will add more than 1,250 residential units and 23,000 square feet of retail space, dramatically reshaping this section of the Hudson River waterfront. The development’s proximity to the Exchange Place PATH station and the Harborside stop on the Hudson Bergen Light Rail ensures residents and visitors will enjoy seamless access to transit, connecting them to Manhattan and the greater metropolitan area. The project exemplifies the ongoing trend of converting Jersey City’s industrial and underutilized waterfront areas into modern, mixed-use urban communities that combine residential living, retail amenities, and public spaces.

This acquisition and redevelopment underscore Jersey City’s position as one of New Jersey’s most active and dynamic real estate markets, attracting major investment and transforming historic industrial zones into vibrant, livable, and economically significant districts.

Hearthside Announces Major Redevelopment in Haddon Township with Expanded Dining and Retail Space

Haddon Township is set to welcome a significant addition to its dining and retail landscape as Hearthside, the acclaimed fine dining establishment, prepares to relocate from Collingswood in the coming year. The new location reflects a thoughtful redesign aimed at enhancing both the culinary experience and the property’s community presence, featuring expanded facilities, additional amenities, and a dedicated retail component. Readers seeking more updates on New Jersey property and development projects can explore the real estate section on Explore New Jersey.

The new Hearthside space introduces a second-story lounge designed to offer patrons a more elevated and private dining experience. This addition is complemented by an enclosed outdoor area, providing a flexible setting that can accommodate seasonal dining, private events, or casual gatherings, while maximizing the property’s footprint. The design merges modern aesthetic touches with functional enhancements to meet the expectations of today’s diners, offering both sophistication and comfort in a single setting.

In addition to the expanded dining area, Hearthside’s redevelopment plan incorporates a separate retail space within an adjoining storefront. This new commercial component is intended to complement the restaurant’s operations while creating a versatile hub for local commerce. By including retail alongside its primary dining services, the property is positioned to serve as a destination for both culinary enthusiasts and shoppers, contributing to Haddon Township’s growing reputation as a vibrant community for mixed-use developments.

The relocation and redesign of Hearthside reflect broader trends in New Jersey’s property market, where dining and retail establishments are increasingly integrating experiential and multifunctional elements into their spaces. Properties that combine hospitality with retail or entertainment amenities are attracting significant attention from developers and investors seeking to maximize engagement and revenue per square foot. Hearthside’s plan exemplifies this approach, creating a dynamic environment that enhances the local streetscape while offering a high-end culinary experience.

As Hearthside prepares to open its doors in Haddon Township, the project is expected to not only elevate the restaurant’s offerings but also contribute to local economic activity. The expanded footprint, modernized facilities, and retail integration position the property as a model for adaptive redevelopment in suburban New Jersey, blending community engagement, commercial viability, and architectural innovation.

Other key market activity includes Belleville’s 158-unit rental property sale for $56 million to a family office, and continued multifamily investment in Fort Lee and Metuchen. Retail remains mixed but resilient; select concepts such as Wingstop and honeygrow continue to expand, illustrating pockets of growth amid broader sector pressures. NAIDB has completed several retail leases and property sales along Sloan Avenue in Hamilton, complementing the industrial expansion in that region.

New Jersey’s industrial market appears to have stabilized after ten consecutive quarters of rising vacancy, holding steady at 7.2% in the third quarter of 2025. Meanwhile, office spaces are beginning to recover as businesses calibrate hybrid staffing models, driving renewed interest in high-class offices, AI-focused sectors, and data centers. NJ Transit is taking an innovative approach to its real estate portfolio, proposing monetization of up to 8,000 acres for potential housing development and industrial leases, which could generate nearly $1.9 billion in revenue and create up to 20,000 residential units.

Signature redevelopment projects like the Hearthside expansion in Haddon Township further illustrate the continued reinvention of New Jersey’s commercial and mixed-use landscape. The project’s second-story lounge, enclosed outdoor space, and new retail storefront will redefine the property’s presence and demonstrate the growing importance of lifestyle-oriented commercial planning.

As New Jersey heads into 2026, its commercial real estate sector reflects a dynamic balance of industrial strength, waterfront transformation, and targeted urban investment. The combination of strategic financing, large-scale multifamily development, and adaptive reuse projects ensures that the state remains a national leader in commercial property activity, offering long-term opportunities for developers, investors, and residents alike.