For many New Jersey renters and prospective homeowners, the question of affordability is front and center: what salary is actually required to purchase a house in the Garden State? A recent analysis by real estate expert Robert Dekanski of Re/Max provides a detailed and sobering answer, offering a county-by-county breakdown of what it takes to secure a mortgage in one of the nation’s most expensive housing markets.

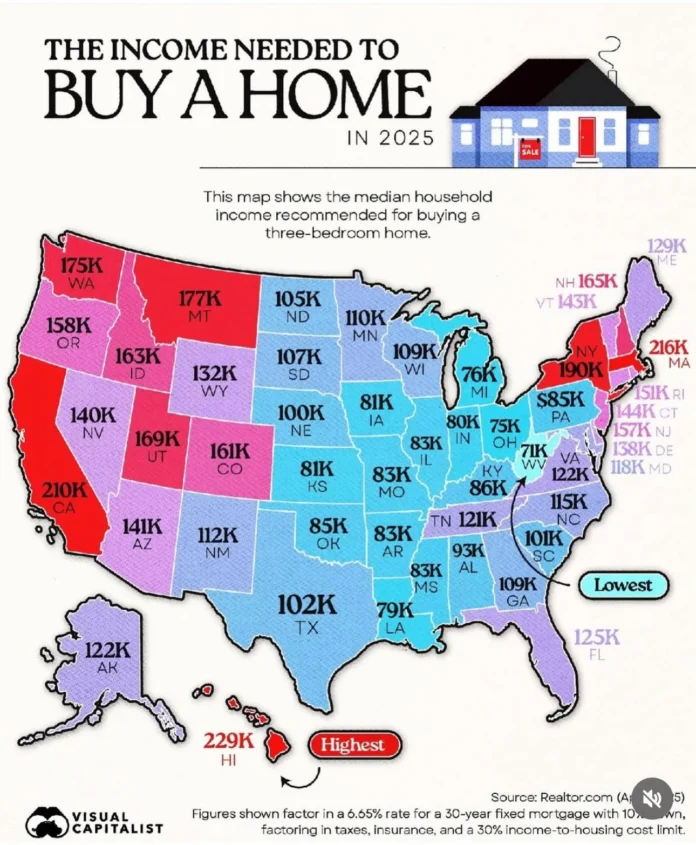

Dekanski’s 2025 report finds that the average household must earn approximately $152,186 annually to comfortably afford a typical New Jersey home. This figure places the state as the ninth most expensive in the country for homeownership, a reflection not only of high median home prices but also of New Jersey’s famously steep property taxes. These taxes often add an extra 15 to 20 percent to monthly housing costs, pushing affordability to the edge for many buyers.

The cost of buying a home in New Jersey varies dramatically depending on location. Northern counties remain the priciest, reflecting proximity to New York City, strong local economies, and highly sought-after school districts. Bergen County, for instance, has a median home price around $790,000, requiring an annual household income between $180,000 and $200,000 to comfortably manage mortgage payments, property taxes, and insurance. Morris County follows closely, with median home prices near $723,000 and salary expectations ranging from $155,000 to $170,000. Somerset County buyers need roughly $145,000 to $160,000 annually for a $680,000 home, while Essex County sits slightly lower at $140,000 to $155,000 for a $705,000 property. Union County, though comparatively less expensive, still demands $135,000 to $150,000 for a $695,000 median-priced home.

Monmouth County continues to rank among the higher-cost areas due to its Atlantic shore access, strong school districts, and convenient NYC commuter options. Buyers in Monmouth need annual incomes between $165,000 and $180,000 to afford a median $710,000 home. Middlesex County, by contrast, offers more accessible options in Central Jersey. With a median home price around $555,000, prospective homeowners in Middlesex typically need $130,000 to $145,000 in annual income. Its location near major employment centers, combined with solid transit access, makes it a popular choice for families and young professionals seeking balance between affordability and convenience.

In contrast, southern and western counties offer significant affordability advantages, albeit with trade-offs in terms of employment density and commuting time. Cumberland County, with a median home price of roughly $270,000, requires only $55,000 to $65,000 in annual income. Salem County is comparable, with $58,000 to $68,000 needed for a $265,000 home, and Warren County offers a slightly higher bar at $85,000 to $95,000 for a $425,000 property. While these areas are appealing for first-time buyers or those seeking lower-cost alternatives, residents often contend with fewer major employers, longer commute times, and less immediate access to urban amenities.

Dekanski’s analysis underscores the multifaceted nature of New Jersey housing affordability. Prospective homeowners must consider not just list prices, but the cumulative cost of property taxes, homeowners insurance, maintenance, and the higher general cost of living that comes with residing in one of the nation’s most expensive states. For those navigating the Garden State’s real estate market, understanding these county-by-county nuances is crucial for making informed purchasing decisions.

For individuals and families exploring opportunities in New Jersey’s housing market, resources on regional development, property trends, and real estate insights can be found in Explore New Jersey’s real estate coverage. With demand continuing to outpace supply in many northern and central counties, careful planning and awareness of income requirements remain essential for anyone looking to achieve homeownership in 2025.

Whether considering Bergen’s high-end suburban neighborhoods, Monmouth’s shore-adjacent communities, or the more affordable regions of southern New Jersey, Dekanski’s report provides a detailed snapshot of what it takes to meet the financial realities of buying a home today. With proper preparation, knowledge of local market conditions, and strategic financial planning, prospective buyers can navigate the Garden State’s challenging real estate landscape and identify options that balance affordability, location, and lifestyle needs.